Showing all 14 results

-

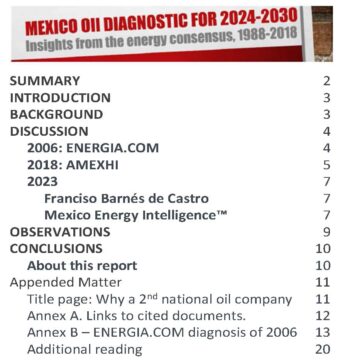

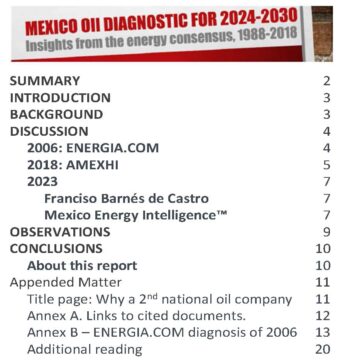

MEI 972 Mexico Oil Diagnostic for 2024-30

DetailsInsights from the energy census, 1988-2018: ...$50.00 Add to cart -

Mexico Oil Diagnostic For 2024-2030

DetailsFor three decades (1988-2018), a consensus ...$10.00 Add to cart -

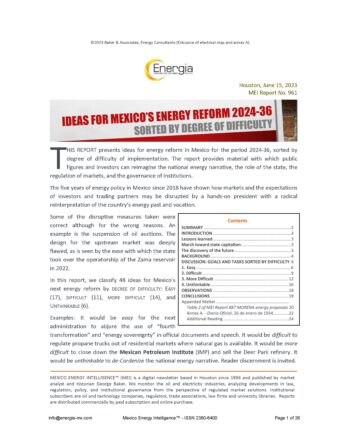

Ideas for Mexico’s Energy Reform, 2024-36 (Part 3, MEI 970)

DetailsReport MEI 970, a printable version – This ...$100.00 Add to cart -

Ideas for Mexico’s Energy Reform, 2024-36, Part 2 (MEI 969, printable)

DetailsThis report (a printable version) is the second ...$50.00 Add to cart -

Ideas for Mexico’s Energy Reform, 2024-36, Part 2 (MEI 969)

DetailsThis report (screen version only) is the second ...$10.00 Add to cart -

Toward a Philosophy of Mineral Energy: Reverse Engineering of the U.S. Minerals Regime (MEI 960)

DetailsThis report reviews the ideas presented to law ...$50.00 Add to cart -

How Morena Wins In 2024 With Help From the Industrial-Military Complex (MEI 962)

DetailsThis report asks about the possible influence of ...$50.00 Add to cart -

Uber drivers in Mexico City opine (Market Comment 117)

DetailsThis report examines aspects of the gasoline ...$50.00 Add to cart -

Ideas for Energy Reform in Mexico, 2024-36 (MEI 961)

DetailsThis report presents 48 ideas in summary form for ...$50.00 Add to cart -

Newton’s Laws In Mexican Politics (Market Comment 115)

DetailsThis report observes that the theory, practice ...$25.00 Add to cart -

Zama and the Failure of Mexico’s Energy Reform (Market Comment 116.1, portfolio edition)

DetailsThis hybrid product includes an Acrobat portfolio ...$2,500.00 Add to cart -

Zama and the Failure of Mexico’s Energy Reform (Market Comment 116)

DetailsThis report identifies failures of design and ...$50.00 Add to cart -

2023 North American Corn and Energy Summit (Public Policy Perspective 10097)

DetailsThis report provides a perspective on Mexico’s ...$250.00 Add to cart -

Challenges for Energy Day® 2022: Heuristic Keynote Address (Public Policy Perspective 10096)

DetailsThis report is an imaginary keynote address ...$50.00 Add to cart