Dr. Baker’s address to the Mexican Academy of Engineering is based on a report (MEI 967). Read extracts

Dr. Baker’s audio address to the Mexican Academy of Engineering. Click here

Present, Past and Future of Energy in Mexico

Investors' source of insight on Mexico's oil and power industries since 1996

Drill into Mexico's energy industries, politics and institutions

ANNUAL CATALOGS GROUPED by sexenio

In this section, we group our annual catalogs by presidential term, starting with Ernesto Zedillo (1994-2000) and continuing to Andrés Manuel López Obrador (2018-24). Reports may be purchased individually (US $50), by year (US $1,000), or by presidential term (US $2,500). For many of these reports, sample pages are available on request: info@energia-mx.com. To be redirected to our Annual Catalogs page, click here.TOPICAL CATALOGS

In this section, we create catalogs on selected topics. Reports may be purchased individually (US $50) or by topic (US $1,000). For many of these reports, sample pages are available on request: info@energia-mx.com. For each topic, we offer an overview.OFFSHORE SAFETY

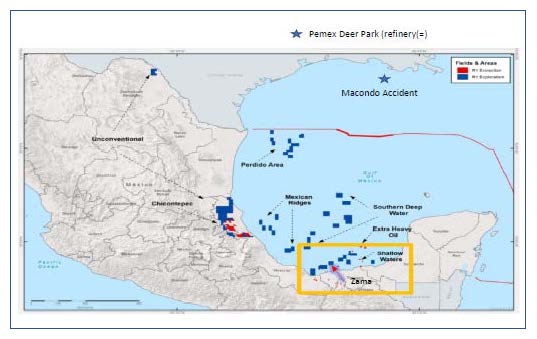

PEMEX'S two-billion dollar platform losses in recent years (Nohoch Alfa in 2023 and Abkatún Alfa in 2015) point to a faulty safety regime and a lack of engagement with U.S. and European safety authorities. Such accidents represent failures of leadership, procedures (recruitment, training, maintenance, supervision), regulation, and public oversight. The billion-dollar fire that consumed a Pemex platform on July 7, 2023 should be a warning. Offshore safety in the Gulf of Mexico (GOM), which is shared by Cuba, Mexico and the United States, lacks coordination and a common framework for training, evaluation, and risk mitigation. Data made available to the public is misleading or non-existent. In the United States, authorities publish statistics on safety incidents in oilfield operations in federal waters, but not specifically for those in the GOM. Data on safety incidents in waters of state jurisdiction, if published at all, are not aggregated with federal data to give a comprehensive picture. On Mexico’s side, Pemex publishes data on safety incidents measured by frequency and gravity scaled to the number of hours in “at risk” operations. As the total number of such hours is not published, the reader cannot discern if the rate of safety incidents is increasing or decreasing from one reporting period to the next. Worse, Pemex’s safety data is aggregated. There is no separate reporting for offshore accidents. As for the safety performance of private operators, there seems to be no obligation to report them to the public. The hydrocarbon safety agency (ASEA), created in 2014, has a minuscule budget and staff. It has earned the nickname “PowerPoint Safety Agency.” In Houston, the Center for Offshore Safety (COS), founded soon after the Macondo mega-oil spill by the American Petroleum Institute (API) to calm public anxiety. Since then, it has promoted safety dialogues between GOM operators, contractors, and regulators. What it hasn’t done is engage with Mexico. “Our mission stops at the U.S.-Mexico maritime boundary,” COS director Russell Holms told us. Several years ago, expressive of their U.S. GOM focus, API and COS discontinued their subscription to Mexico Energy Intelligence™. These facts and considerations come together in a worrisome outlook for GOM offshore safety. For a selected list of reports on Offshore Safety, click here.DEER PARK REFINERY

In opinion pieces in The Houston Chronicle and Mexico City’s Reforma, we opposed the sale by Shell Oil Company of its controlling share in the Deer Park Refinery to a twice-removed affiliate of Pemex. Instead of buying Shell’s interest, in 2017, we had discerned that it would be better for Pemex to find a buyer for its minority share. The Houston-area public has a legitimate concern about how responsibility for environmental liability and decommissioning was negotiated in the sales agreement. The new legal owners are holding companies without a balance sheet that could cover the cost of a major accident or a billion-dollar decommissioning cost. The terms regarding Shell’s residual liability for environmental remediation are confidential. For a selected list of reports on Deer Park Refinery, click here.ENERGY REFORM

The starting point for Mexico’s Energy Reform of 2013-18 is an appreciation of the false cognate relationship between “reform” in English and “reforma” in Spanish. The first refers to the correction of a harmful pattern (as “prison reform”), while the second has no connotation of error-correction whatsoever. “Reformar” means to edit or amend as of an article of the constitution. In this way, the new market designs for oil and electricity were edits to the status quo, not the long-overdue corrections of an investment-stiffling regime. Space was opened in law and regulation in oil production and transportation and in the retail sales of refined products. In the electricity market, investors were allowed only to participate in generation. What was allowed to stay the same—unedited—was the looming figure and vast discretionary authority of the president of Mexico in both the oil and power markets. The reversals of fortune of investors in both markets under President López Obrador point to faulty market designs and an unwillingness of political elites in Mexico to commit to sustainable energy markets. For a selected list of reports on Energy Reform, click here.

LAW

We evaluate energy laws, regulations, and policy choices by the measure to which they promote an increased supply of natural resources—to include oil, geothermal, lithium, and renewables—and their respective transformation into energy resources for businesses and households. By this measure, choices made in Mexico in 1917, 1938, 1958, 2018, 2021, and 2022 have the common feature of restricting energy supply. We put most of the blame for these outcomes on the language, philosophy, and popular appeal of energy socialism in Mexico, as seen in the preference for state control over private investments and markets and as memorably expressed in Article 17 of the constitution of 1917. For a selected list of reports on law, click here.ROUND 1.1

At an industry conference held in Houston in late 2014, Lourdes Melgar, Mexico’s Under-Secretary for Hydrocarbons, told the audience that one of Mexico’s advantages in being the last to open its petroleum estate to private investors was that it benefits from the experience of other jurisdictions. By the end of the day on July 15, 2015, however, when the design and execution of the first oil lease auction had been completed and the results were known, investors realized that Dr. Melgar had been far off the mark. True, Round 1.1 was the first oil auction in Mexico’s history, but—as we document in our reports—the details of design and execution flaunted international practices and investor expectations. For selected reports on Round 1.1, click here.USTR COMPLAINTS

On July 20, 2022, the U.S. Trade Representative (USTR) published a request for an Investor-Dispute Consultation with Mexico, alleging a pattern of possible violations of the U.S.-Mexico-Canada trade and investment agreement of 2020 (USMCA). Bizarrely, there was no reference to the history of irregularities since 2018 in the upstream, which could easily have been construed as possible USMCA violations. Again bizarrely, at the 2022 annual meeting of the U.S.-Mexico Chamber of Commerce (USMCOC), held in Washington, D.C., on September 21, during the public remarks of the USTR’s Deputy Director Jaime White, there was no mention of a trade dispute. As of July 2023, eight months beyond the date on which the USMCA allows for the convening of an arbitration panel, USTR has not pulled the trigger. For a selected list of reports on USTR Complaints, click here.ZAMA CONTROVERSY

Mexico’s reputation as an investment designation for international oil companies has been tarnished—for at least a generation—by the official mistreatment of private investors in Block 7 of Round 1.1. A consortium, led by Houston’s Talos Energy, LLC in 2017, discovered a near-giant offshore oil reservoir in Pemex’s backyard. Had subsequent events followed global expectations, the reservoir named Zama in 2023 would produce 150,000 barrels of oil daily. Instead, work on the reservoir has been hamstrung by a history of dissimulations and irregularities. First oil production is still years away. In an article published in The Houston Chronicle on August 7, 2020, we warned the oil industry of this scenario—which would take another two years to unfold. In May 2023, the news that presidential insider Carlos Slim had offered to buy 49% of the working interest of Talos served to transform the attitude and narrative of President López Obrador from hostility to enthusiasm. For a selected list of reports on Zama Controversy, click here.BILINGUAL PROFICIENCY

The Mexican government under President Andrés Manuel López Obrador is the least bilingual administration since 1976. In 2019, the director-general of Pemex was invited as a keynote speaker at the Offshore Technology Conference, but the invitation was withdrawn when it was learned that he would not be able to present in English. Despite the importance of English proficiency in all areas of science, technology and commerce, Pemex has not yet developed English-language proficiency training for its employees. In our reports and workshops on bilingual proficiency, we emphasize the sequence MIND → EAR→TONGUE. There is little point in learning vocabulary terms if the student cannot hear the languages spoken to him or her by a native speaker. To hear requires an understanding of of the phonetic system of the target language, particularly the subsystem of vowels. Where Spanish has precisely five vowels, English—depending on who’s doing the counting—has between 15 and 20 vowels, only two of which are found in Spanish (/a/ and /e/). We regard the study of the vowel trapezoid and the symbols of the International Phonetic Alphabet (IPA) as essential tools for learning to hear another language. Finally, we insist that learning the fine points of pronunciation creates a trust credential in the mind of the native speaker, who, to himself or herself, says “You have listened carefully to my language. Perhaps you’ll also listen carefully to what I’m now telling you.” For a selected list of report titles on Bilingual Proficiency, click here.

Follow us on X (ex-Twitter)

This prescient assessment was published five months before the promulgation of the energy reform legislation on August 11, 2014. Its arguments are worth rereading today.

An interview with George Baker on the state of the energy sector in Mexico.

Read MEI Sample Pages & Purchase

-

MEI 972 Mexico Oil Diagnostic for 2024-30

More infoInsights from the energy census, 1988-2018: ...$50.00Add to cart -

Mexico Oil Diagnostic For 2024-2030

More infoFor three decades (1988-2018), a consensus ...$10.00Add to cart -

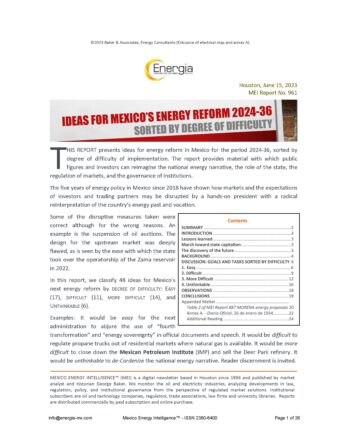

Ideas for Mexico’s Energy Reform, 2024-36 (Part 3, MEI 970)

More infoReport MEI 970, a printable version – This ...$100.00Add to cart -

Ideas for Mexico’s Energy Reform, 2024-36, Part 2 (MEI 969, printable)

More infoThis report (a printable version) is the second ...$50.00Add to cart -

Ideas for Mexico’s Energy Reform, 2024-36, Part 2 (MEI 969)

More infoThis report (screen version only) is the second ...$10.00Add to cart -

Toward a Philosophy of Mineral Energy: Reverse Engineering of the U.S. Minerals Regime (MEI 960)

More infoThis report reviews the ideas presented to law ...$50.00Add to cart -

How Morena Wins In 2024 With Help From the Industrial-Military Complex (MEI 962)

More infoThis report asks about the possible influence of ...$50.00Add to cart -

Uber drivers in Mexico City opine (Market Comment 117)

More infoThis report examines aspects of the gasoline ...$50.00Add to cart -

Ideas for Energy Reform in Mexico, 2024-36 (MEI 961)

More infoThis report presents 48 ideas in summary form for ...$50.00Add to cart -

Newton’s Laws In Mexican Politics (Market Comment 115)

More infoThis report observes that the theory, practice ...$25.00Add to cart -

Zama and the Failure of Mexico’s Energy Reform (Market Comment 116.1, portfolio edition)

More infoThis hybrid product includes an Acrobat portfolio ...$2,500.00Add to cart -

Zama and the Failure of Mexico’s Energy Reform (Market Comment 116)

More infoThis report identifies failures of design and ...$50.00Add to cart -

2023 North American Corn and Energy Summit (Public Policy Perspective 10097)

More infoThis report provides a perspective on Mexico’s ...$250.00Add to cart -

Challenges for Energy Day® 2022: Heuristic Keynote Address (Public Policy Perspective 10096)

More infoThis report is an imaginary keynote address ...$50.00Add to cart